Jan 15, 2016 @ 11:39 am

While we were reveling in New Year’s festivities, Medicare ushered in a new income scale as the basis for Medicare high-income surcharges. The bottom line is that more of your Medicare clients will pay more for their Medicare Parts B and D in 2018. That’s Medicare’s way of saying Happy New Year!

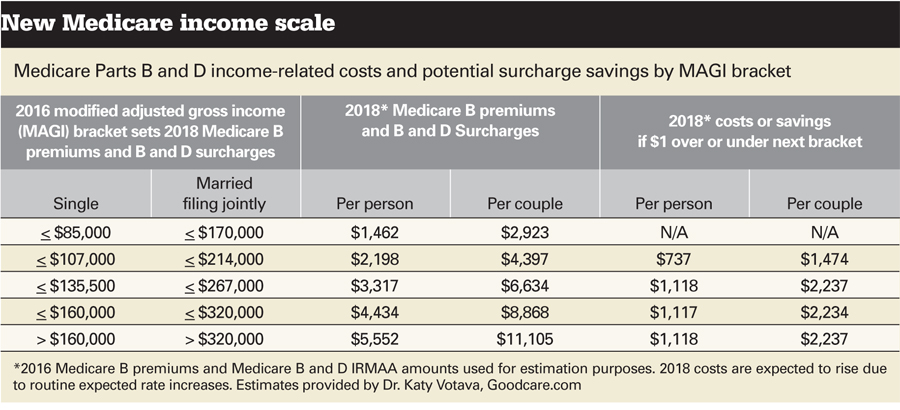

A recent law changed the scale that Social Security uses to determine Medicare surcharges. The new law lowers the top three modified adjusted gross income (MAGI) tier thresholds, which means more beneficiaries will be exposed to paying high levels sooner than is currently the case.

Keep in mind that Social Security uses the MAGI from the tax return two years prior for rate setting. Case in point: While the law stipulates that new tier definitions for modified adjusted gross income go into effect in 2018, the 2016 tax return will be used to set those 2018 surcharges. That is why it is important to incorporate the new MAGI tier structure into retirement planning this year.

The surcharges, officially known as the income-related monthly adjustment amount (IRMAA), create higher Medicare out-of-pocket costs for beneficiaries without providing any additional health coverage benefits. People will spend more out of their own pockets if they are even $1 into the next higher MAGI bracket. Conversely, they can save money by being $1 down into the next lower MAGI.

OPTIONS TO LOWER BRACKET

The good news is that there are several retirement-income planning options for advisers to consider that can help people move down a bracket or two and save their hard-earned nest egg dollars. The basic strategy is to structure retirement income to maximize cash-flow sources that will not be included in Medicare’s MAGI calculation. The lower the MAGI bracket, the lower Medicare Parts B and D surcharges will be without reducing benefits. In fact, those costs can be eliminated in the lowest MAGI tier.

One method of achieving this goal is to use a reverse mortgage to give tax-free cash flow to your clients. A reverse mortgage, also known as a home equity conversion mortgage (HECM), is a particular type of home loan for people over 62 years old. Borrowers can tap into a portion of the value in their primary residence. While borrowers are not obligated to make payments on the mortgage balance, they are still responsible for property taxes and homeowner’s insurance. The owner may pay down some or all of the HECM balance, if they choose, over the life of the mortgage. HECMs are insured by the Federal Housing Administration and have more protections for the borrower than in the past. The loan proceeds are tax-free and, therefore, are not included in the calculation of Medicare IRMAA surcharges.

I recommend that you look very carefully at the MAGI brackets when your clients are in circumstances when they are using taxable income sources to meet expenses. Consider whether an HECM line of credit can be utilized instead to supplement taxable distributions to keep a person from going over into the next Medicare surcharge bracket. The flexibility of using an HECM line of credit can also provide other benefits.

Tom Dickson, the founder of Financial Experts Network, collaborates with financial planners on the use of HECMs as part of various planning strategies. “Financial planners are increasingly interested in using an HECM, for a relatively low cost, to reduce a client’s taxes by lowering the amount they withdraw from qualified accounts,” he said. “For every $10,000 a client withdraws from an IRA, they could instead draw $7,500 from an HECM to provide equal purchasing power. Plus, that IRA money is left in place to grow. I see similar benefits from using an HECM to reduce MAGI as part of Medicare planning.”

‘BEST, SMARTEST PLACE’

Becky Bell, vice president of affiliate channels with Longbridge Financial, works closely with advisers to help them explore options for their clients. Ms. Bell said that it was important to think of home value as another pot of money to be considered when dissipating assets. Home equity can, at times, be “the best, smartest place to pull money from, particularly considering the opportunity cost of liquidating other assets,” she said.

All of the potential uses of reverse mortgages for retirement cash flow need to be considered in the context of comprehensive retirement planning. I suggest that you explore strategies that can enhance your client’s access to tax-free cash sources, including reverse mortgages, which will, among other things, keep Medicare surcharges as low as possible. That will help create a happier New Year in the years to come for your clients.